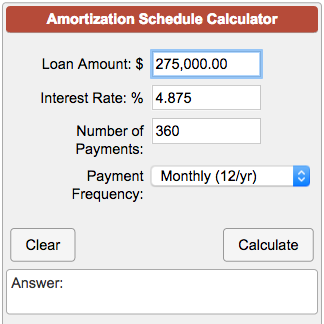

Use our car loan calculator to estimate what your monthly loan payment should. For example, if you know how much you can afford for a monthly payment over a certain number of months and you want to calculate how much money you might afford to borrow, you can enter Interest Rate, # of Payments, and Monthly Payments and click "compute" to calculate what the Principal will be. Many factors impact the loan amount for the purchase of a new or used vehicle. Our car payment calculator can help you determine how an automotive purchase from Leith Volkswagen in Raleigh, NC fits into your budget. You can actually use this calculator to estimate any of these pieces by filling in the three known amounts and clicking "compute". Financing for 84-month terms is only available on new auto loans (model years 2021 to 2023) and requires financed amount of 25,000 or greater and approved. Monthly Payment is the estimated amount of money you will need to pay each month to pay off the loan.If you want to borrow $7,500 you would enter 7500 in the Principal blank Principal is the amount of money you want to borrow.For example, if the approximate term of the loan is 4 years or 48 months, you would enter 48 in the # of Payments blank # of Payments is the number of monthly payments you will make to pay off the loan.If the loan rate is 6.5% you would type 6.5 into the Interest Rate blank Interest Rate is the APR from the loan rate chart.When entering information into the calculator, please use the following guidelines: You can compare information on up to three different Loan Options at one time. Entering Information into the Loan Calculator NOTE: Javascript is required to use the loan calculator. This calculator is commonly used to estimate your monthly payment, by filling in the following information and click compute: Interest rate Number of. After paying income taxes on a 53,924 salary, the take-home pay is reduced to 43,422. If there are no blank fields, the Monthly Payment will be calculated. In 2022, the average new car price exceeded 47,000, and the median salary is 53,924 for a full-time worker. To calculate any of these items, simply leave that field blank and press Compute. Use our free calculator to figure out what your monthly payment should be, and how interest rate and loan term impact your payoff amount for your auto loan. Amount of money you need to borrow (the principal). How quickly (in months) do you plan to pay off the car loan Typically loan terms are offered at 36, 48 and 60 months. Use this calculator to help you determine your monthly car loan payment or your car purchase price.Here is a list of our partners who offer products that we have affiliate links for.This calculator is commonly used to estimate your monthly payment, by filling in the following information and click "compute": Need to estimate your monthly car loan payments Use our handy online auto financing calculator below to see how much itll. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Second, we also include links to advertisers’ offers in some of our articles these “affiliate links” may generate income for our site when you click on them. This site does not include all companies or products available within the market. Monthly Payment by Years and Interest Rate.

The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. How much is a 36,000 auto loan Common loan lengths are 3 years, 4 years, or 5 years. First, we provide paid placements to advertisers to present their offers. This compensation comes from two main sources. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The Forbes Advisor editorial team is independent and objective.

0 kommentar(er)

0 kommentar(er)